GPU Availability Trending Downward – Cryptomining is the Culprit.

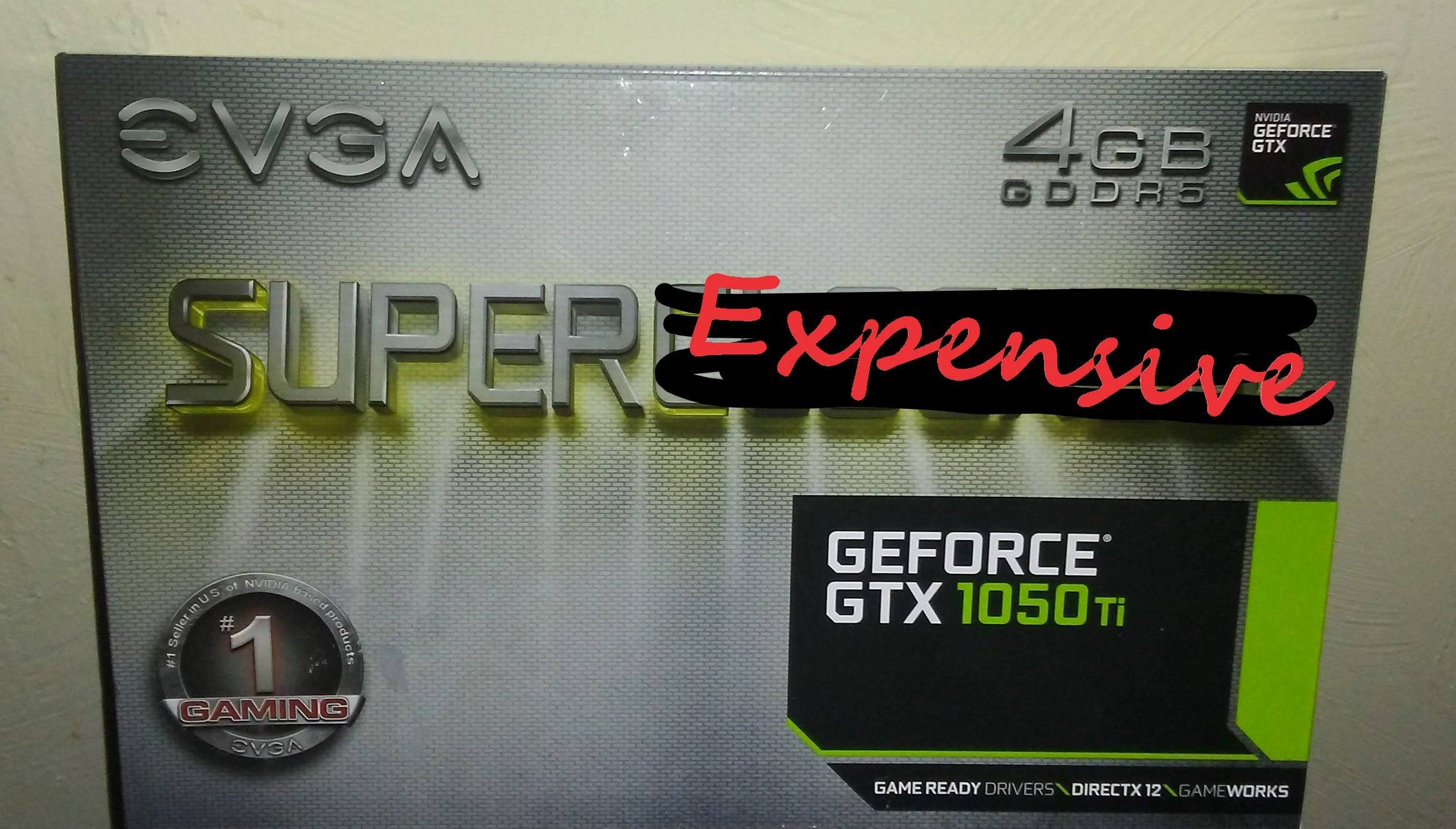

Ask anyone looking to build a PC for gaming or cryptomining and they’ll tell you the same story: GPU availability trending downward is reality. As a result of supply and demand GPU prices are through the roof. A recent boom in popularity of cryptocurrencies, like Ethereum or Monero, has led to a record high demand for GPUs driven by crypto mining. Such high popularity of cryptocurrencies has led to GPU prices trending upward. Yet, higher prices aren’t helping shore up supply. Both major retailers of consumer-end graphics cards, Nvidia and AMD, are experiencing a supply shortfall. Their core markets are also suffering from this relatively sudden price increase and poor availability.

GPU Availability Trending Downward is not an accident….

Demand Far Exceeds Supply

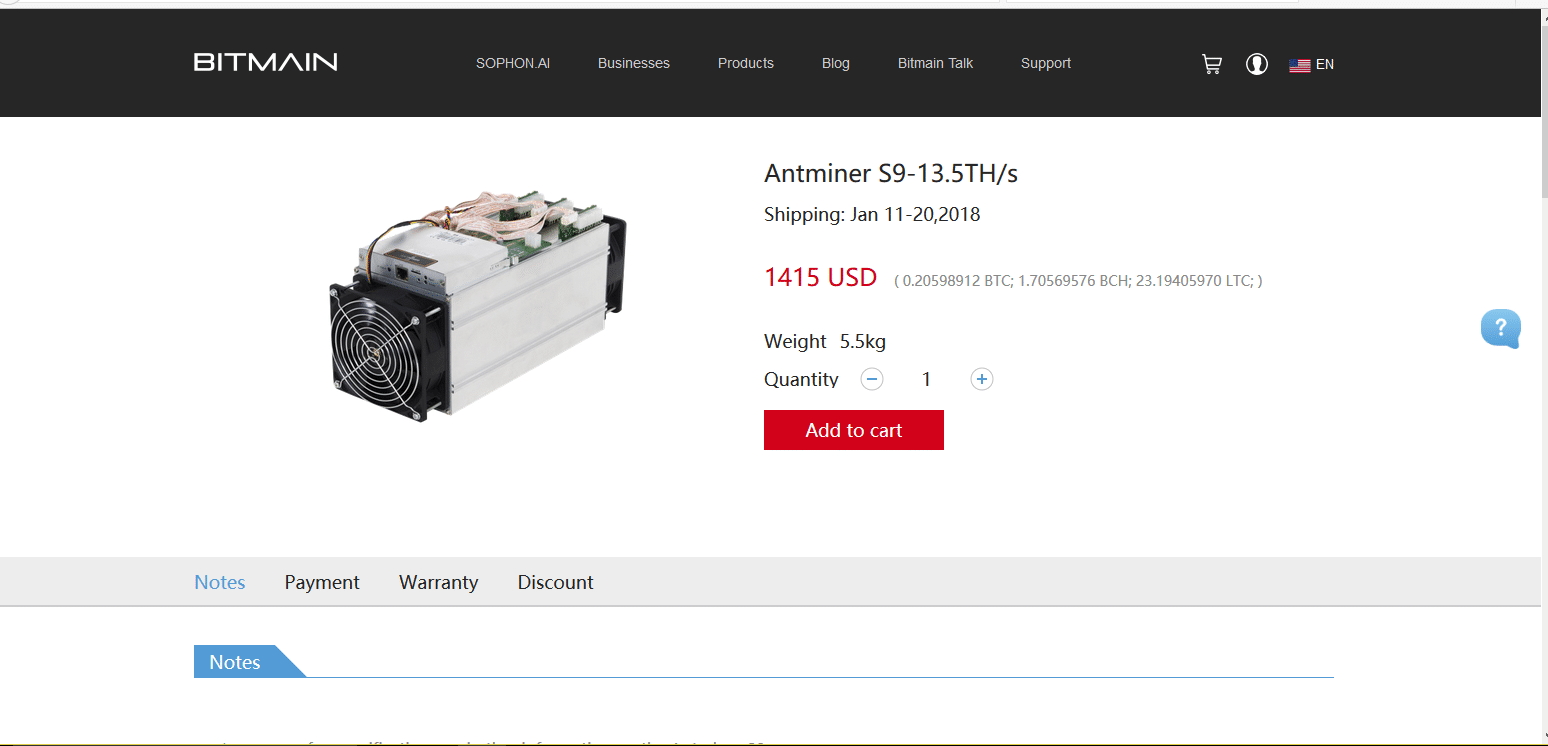

Even with prices for consumer cards on a steady rise, many retailers and even GPU manufacturers can’t seem to keep GPUs in stock. But the rise in GPUs scooped up for cryptocoin mining isn’t the sole culprit in this matter. ASIC manufacturers, such as Bitmain, are buying out major foundries so they can keep pace with demand for ASIC miners. This puts foundries like TSMC at a production deficit when it comes to supplying GPU manufacturers like Nvidia and AMD.

While your average end-user won’t notice a huge difference, this shortage is impacting small-time altcoin miners and gamers alike. Prices are being driven ever higher by major mining corporations buying their GPUs en masse from major distributors in China. GPUs are being bought in such bulk that consumers aren’t able to get their hands on a high-end graphics card without paying a hefty price, if they are able to obtain one at all. With markets devoid of stock, and demand doubling or even tripling supply, even having the money doesn’t guarantee you’ll be able to buy the graphics card you want. That’s where GPU availability trending downward hits hardest.

Gamers First

With massive supply shortfalls, GPU manufacturer Nvidia is trying to limit who buys their GPUs. According to Nvidia spokesman Boris Böhles: “For NVIDIA, gamers come first. All activities related to our Geforce product line are targeted at our main audience. To ensure that Geforce gamers continue to have good Geforce graphics card availability in the current situation, we recommend that our trading partners make the appropriate arrangements to meet gamers’ needs as usual.”

AMD has similar issues. Trying to get the latest Radeon graphics card will likely cost you a small fortune, if you’re able to buy one at all. AMD’s Radeon line tends to be more popular with miners due to their reputation of having better mining efficiency than Nvidia’s GeForce line. This leads to getting all but the most entry-level Radeon cards nearly impossible.

With supply issues and the wide unavailability of AMD’s Radeon RX 500 series, AMD is also putting gamers first. According to an AMD spokesperson in an email to CNBC, “The gaming market remains our priority. We are seeing solid demand for our Polaris-based offerings in the gaming and newly resurgent cryptocurrency mining markets based on the strong performance we are delivering.”

The Future for GPUs

While the short-term is definitely horrible for end-users, answers may be just over the horizon. With both major GPU manufacturers acknowledging the problem, perhaps we’re on the cusp of a revolution in GPU technology. We may be seeing the major GPU players developing graphics cards geared specifically at miners while still innovating and improving graphics cards for the hardcore gamers. Only time will tell. One thing is for certain: current GPU market trends are unsustainable for both the miners and the gamers of the world.

Sources:

https://news.bitcoin.com/nvidia-tries-to-limit-gpu-sales-to-cryptocurrency-miners/

https://pcpartpicker.com/trends/price/video-card/

https://www.theverge.com/2018/1/30/16949550/bitcoin-graphics-cards-pc-prices-surge