Should You Buy Used Mining Rigs?

Should You Buy Used Mining Rigs? Yes. Well maybe…. And perhaps no. The option to buy used mining rigs is a tempting one. With the madness surrounding crypto mining and alt-coins, many people are going to look into building their own mining rigs. While this isn’t a huge undertaking for

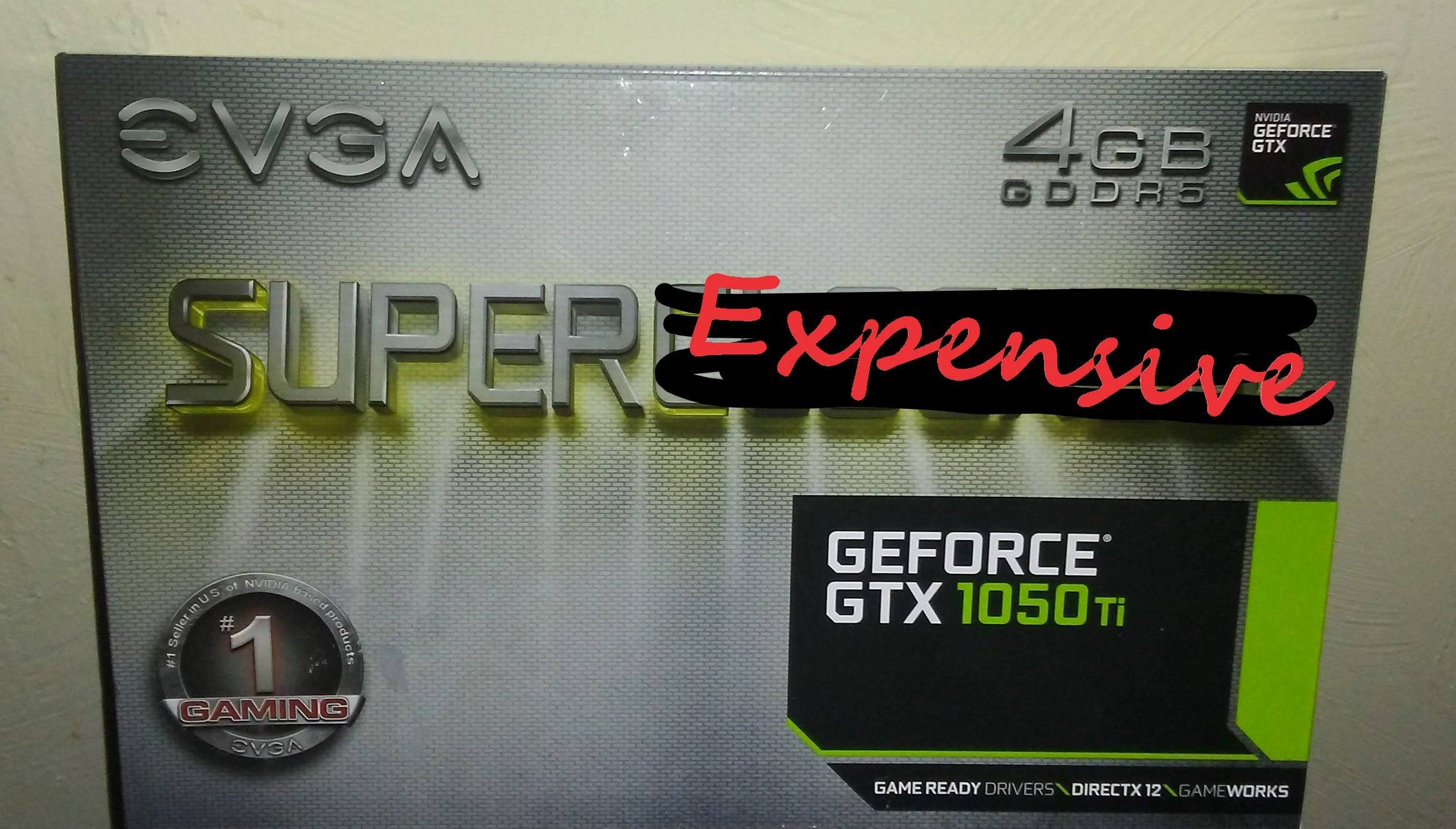

GPU Availability Trending Downward

GPU Availability Trending Downward – Cryptomining is the Culprit. Ask anyone looking to build a PC for gaming or cryptomining and they’ll tell you the same story: GPU availability trending downward is reality. As a result of supply and demand GPU prices are through the roof. A recent boom in

Bitcoin Mining for Beginners – Episode 4: Monero

Episode 4: Trading Monero I recently had a crash course in trading Monero for Bitcoin. Boy was that an adventure! If you haven’t seen my previous episode in this series, please go check it out here. Mining Enough Monero Well, after we’ve setup our miner and found our mining pool