Should You Buy Used Mining Rigs?

Should You Buy Used Mining Rigs? Yes. Well maybe…. And perhaps no. The option to buy used mining rigs is a tempting one. With the madness surrounding crypto mining and alt-coins, many people are going to look into building their own mining rigs. While this isn’t a huge undertaking for

Litecoin Hard Fork Rally

Litecoin Hard Fork Rally – Litecoin Doubled in the Past Seven Days Leading up to the Fork. The Litecoin hard fork rally has Litecoin loyalists jubilant. Litecoin is like the often overlooked younger brother among the major cryptocoins. It is the fifth-largest cryptocurrency by market capitalization, according to CoinMarketCap and is frequently

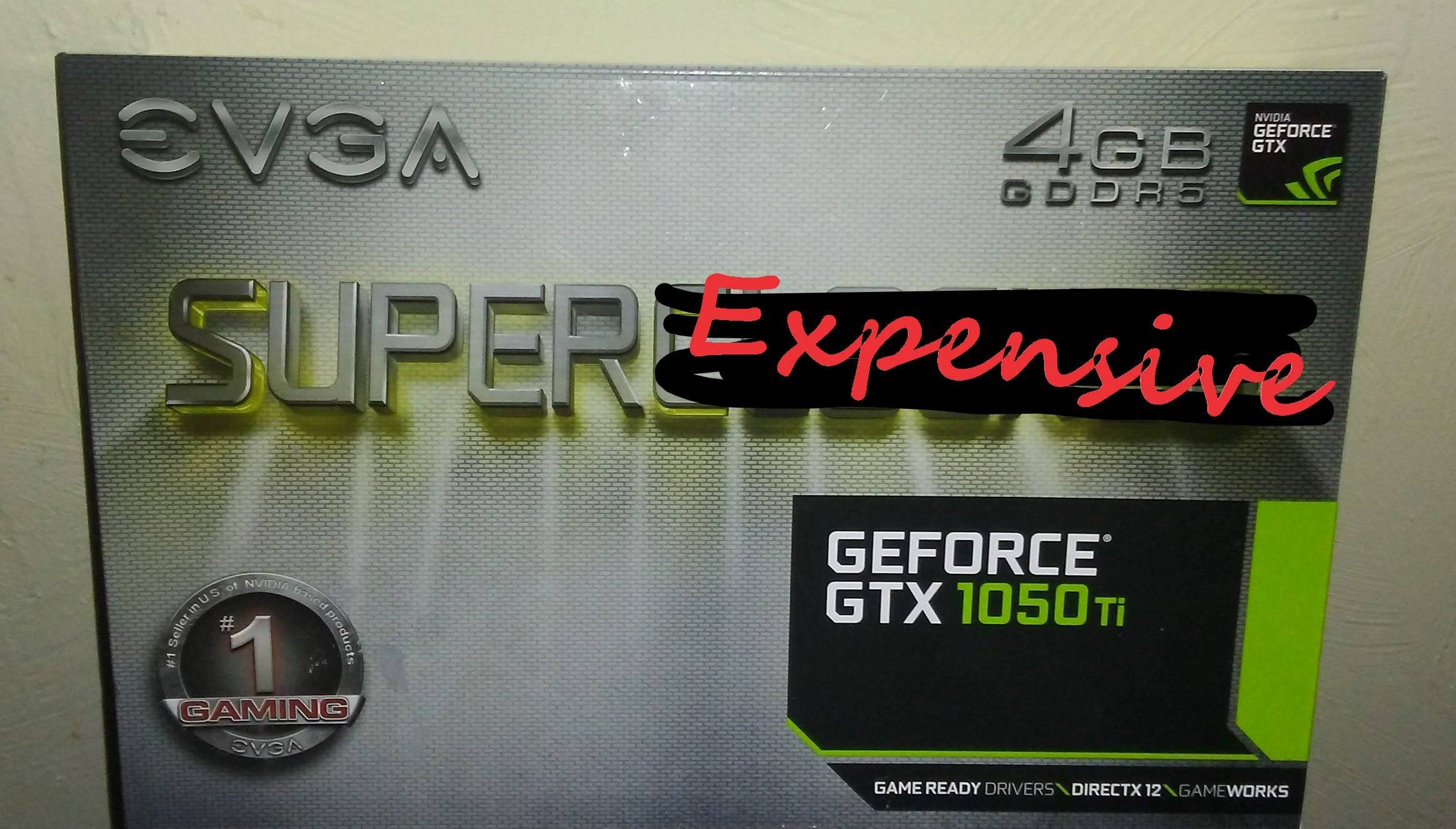

GPU Availability Trending Downward

GPU Availability Trending Downward – Cryptomining is the Culprit. Ask anyone looking to build a PC for gaming or cryptomining and they’ll tell you the same story: GPU availability trending downward is reality. As a result of supply and demand GPU prices are through the roof. A recent boom in