From Bitcoin to Ethereum: The Evolution of Cryptocurrencies

With the rise of cryptocurrencies, it’s crucial to understand the evolution of digital money in the world of technology. From the inception of Bitcoin to the emergence of Ethereum, the landscape of digital currencies has transformed significantly. In this blog post, we will examine the journey of cryptocurrencies, focusing on

Understanding The Basics Of Bitcoin And Its Impact On The Financial World

The basics of Bitcoin have revolutionized the financial landscape, offering a decentralized digital currency that operates without the need for traditional intermediaries like banks. As interest in cryptocurrencies surges, understanding the fundamentals of Bitcoin is crucial for investors and individuals alike. This blog post probes into the fundamental concepts of

Bitcoin Resurgence? 💪🏽🪙😲 #shorts #cryptocurrency #bitcoin

Bitcoin Resurgence? 💪🏽🪙😲 #shorts #cryptocurrency #bitcoin Bitcoin is on the rise again! This video will explain the reasons behind Bitcoin’s recent resurgence. We’ll take a look at the various factors driving the renewed interest in cryptocurrencies and discuss the implications for the future of Bitcoin. Whether you’re a newbie or

How to Assess the Current Cryptocurrency Scene?

How to Assess the Current Cryptocurrency Scene? After Satoshi Nakamoto changed the world forever with his invention, Bitcoin, the cryptocurrency market saw a massive rise. While Ethereum, Litecoin, and Ripple were some of the most popular cryptocurrencies after Bitcoin, while the total number of cryptocurrencies was more than

Coinbase Going Backwards

Coinbase Going Backwards – Elimination of Key Client Services + Needlessly Complicating Merchant Transactions = Disaster Coinbase going backwards has made life much more difficult the past few weeks. Up until March I could sell Bitcoin and turn it into usable cash in less than 30 minutes right from my

Buying Stuff With Bitcoin

Buying Stuff with Bitcoin – It’s a Real Thing. Not Just Lambos or Mansions Either. Buying stuff with Bitcoin has been real for years. From buying a house with Bitcoin to the legendary “Lambo” to anything else, Bitcoin is gaining wider acceptance all the the time. I just bought a

Should You Buy Used Mining Rigs?

Should You Buy Used Mining Rigs? Yes. Well maybe…. And perhaps no. The option to buy used mining rigs is a tempting one. With the madness surrounding crypto mining and alt-coins, many people are going to look into building their own mining rigs. While this isn’t a huge undertaking for

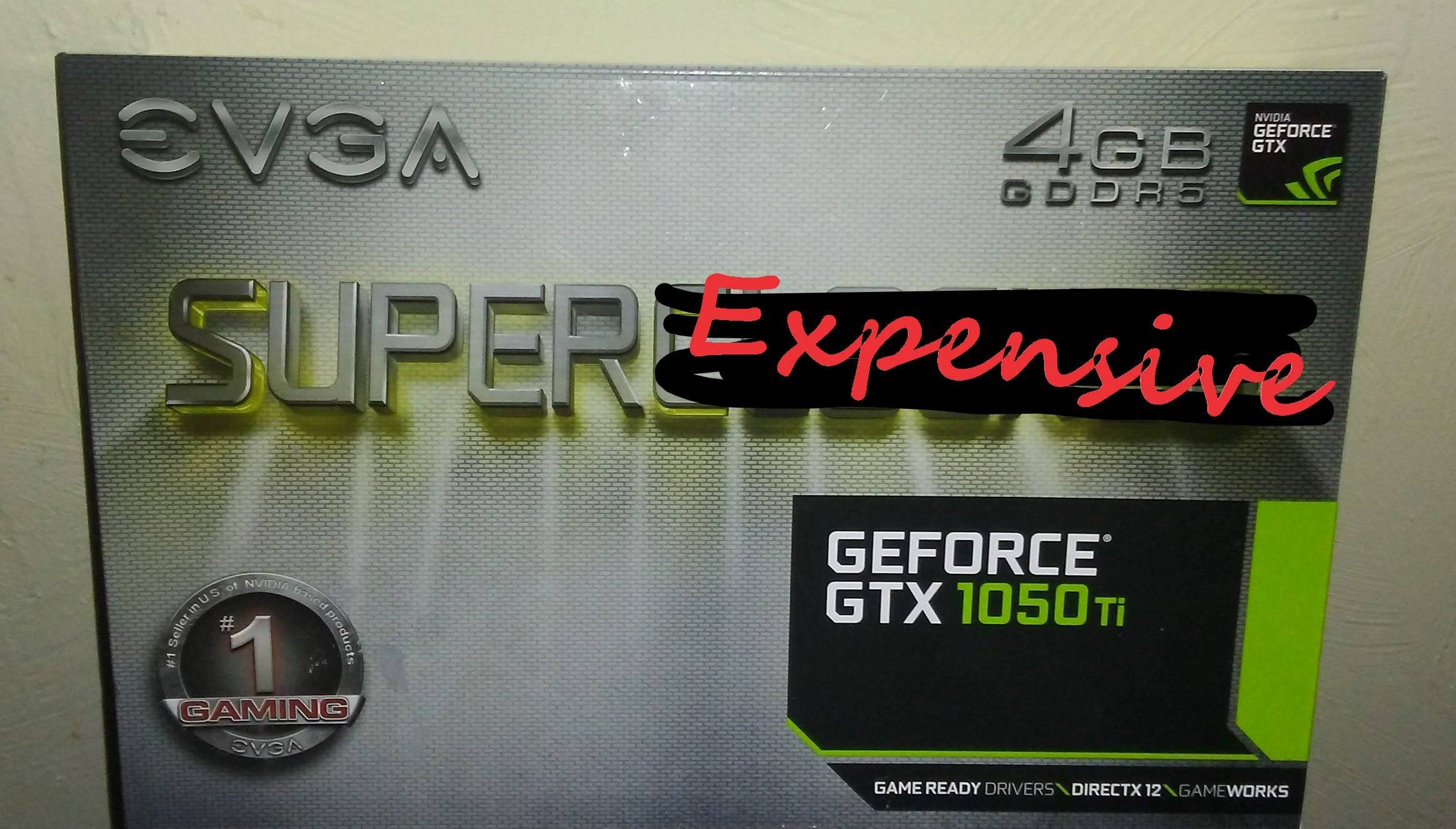

GPU Availability Trending Downward

GPU Availability Trending Downward – Cryptomining is the Culprit. Ask anyone looking to build a PC for gaming or cryptomining and they’ll tell you the same story: GPU availability trending downward is reality. As a result of supply and demand GPU prices are through the roof. A recent boom in

Bitcoin Mining for Beginners – Episode 6: ASIC Miners

Bitcoin Mining for Beginners – Episode 6: ASIC Miners When we last left off, I was sharing my experiences with purchasing my first ASIC miner. Before continuing, I highly recommend reading my previous article here. Bitcoin Mining for Beginners is a complicated topic with lots of moving parts. Writer’s Note: