First Bitcoin Futures Contract Expires as Bitcoin Rises

Is it a coincidence or a convergence of market forces that the first Bitcoin futures contract as Bitcoin rises? It’s difficult to be sure as Bitcoin historically dips in January only to bounce back higher than ever. What complicates this review of Bitcoin history is the factor Bitcoin futures may play. If you step back and consider all of the dynamics in play, it might not be a coincidence that the first Bitcoin futures contract expires as Bitcoin rises – on the same day.

Consider these points:

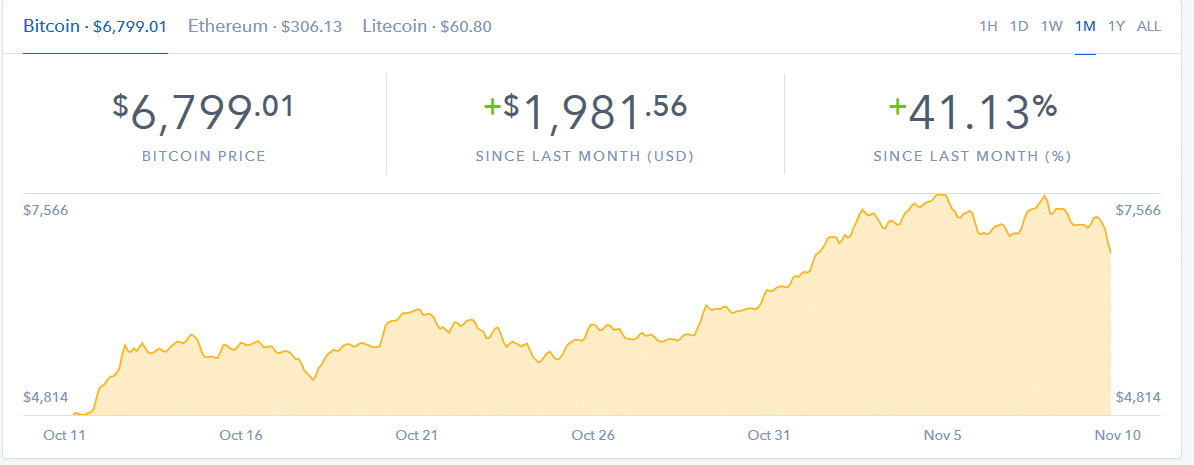

Back in November 2017 the news of Bitcoin futures markets on the CME and CBOE breaks. Right after that, hedge fund managers and affluent investors start buying up Bitcoin which drives it near it’s all time of high of $20,000 knowing full well they would be shorting Bitcoin on the futures market.

Then we have the the first Bitcoin futures contract coming in at around $15,000. Bitcoin whales then start pumping up the price of Bitcon to all time high and making truckloads of money in the process and then start selling BTC and taking their profits which leads to a panic run with BTC selloffs coming in from every direction. The hedge fund managers and other players are very happy to see this because they had already shorted Bitcoin on their futures contracts COUNTING ON THE FACT the price of Bitcoin would plunge. Which it did.

A lot of people would rightfully call “bullshit” on such market manipulations but at the same time it can’t be denied it’s brilliant. Plays like this happen on the stock market all the time. I’ve personally known investors sitting on huge blocks of stocks they own in any given company SHORTING the sale of that same stock BETTING it will go down. Sounds crazy, right? But it isn’t if you run the numbers. They’re covering their bets both ways.

BUT WAIT THERE’S MORE…

After the dramatic plunge of Bitcoin price the past 48 hours every investor worth his salt knows there is an amazing buying opportunity on Bitcoin and other coins at bargain basement prices. So investors big and small — whales and minnows alike — go on a cryptocoin buying frenzy leading to prices driving up across the board. Our founder and editor-in-chief Howard Sherman documented this earlier today.

While it is seldom clear WHY Bitcoin pricing and other cryptocoin values for that matter can move so dramatically so quickly I think we have a viable theory here that it’s no small coincidence that the first Bitcoin futures contract expires as Bitcoin rises.

Here’s an alternative theory to explain the historical price dips and highs in January; Wall Street executives always get their bonuses in mid January. Is the sudden price spike the result of Wall Street players buying Bitcoin now that they have received their bonuses? Is it the new Bitcoin futures markets? A mix of both and perhaps other forces at work as well? Nobody can be sure.

What is certain more than ever is that Bitcoin has become, in every sense, the new gold.