Cryptocoin Markets in 2018 – I Predict Order out Of Chaos

I forecast that cryptocoin markets in 2018 are going to settle down as the 100,000 or so new cryptocoin investors that enter the cryptocurrency trading market e very day end up being sick and tired of being sick and tired. Day in and day out new investors are sickened by the sudden losses and dramatic sides in their portfolio with no sense of assurance other than sticking to the tried and true approaches to HODL and NEVER sell at a loss.

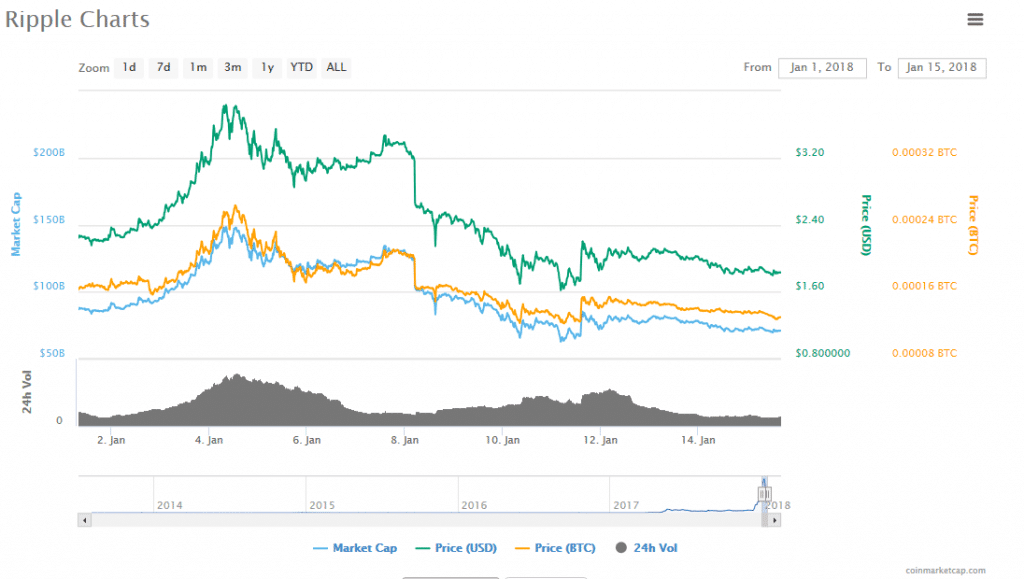

Well that’s all well and good but cryptocoin markets in 2018 have shown that some coins never rebound. Or if they do, it could be a long time coming as cryptocoin investors watch other opportunities come and go. Let’s look at Ripple’s XRP for example…

Ripple was dancing at all time highs on January 3rd and 4th and XRP is down over 50% as I write this article. Note the parallels between the price of BTC and XRP in the above chart. They’re nearly mirror images. Not to pick on Ripple the very same thing happened to Tron (TRX) in THE EXACT SAME TIME PERIOD. Look at the chart for TRX. It crested to an all time high on January 3rd and 4th (just like XRP) and then the price cratered (just like XRP).

Investors who DON’T get out at the highs and instead try and time the market or otherwise hold on for bigger gains are getting disgusted. This is the prevailing sentiment outside the established coins (BTC, ETH, LTC, etc.) and this is what’s going to act as a stabilizing factor for cryptocoin markets in 2018.

I see two things happening as a result; Bitcoin values continue a steady trajectory upwards as the market becomes less diluted by other coins of dubious value (sometimes called shitcoins) that people no longer attempt to speculate in. You can tell the cryptocoin markets in 2018 are in for some serious changes when posts across Facebook, Twitter, Reddit and various other forums are loaded with posts asking for advice on what can be bought for a penny or a nickel or otherwise under a dollar. These folks are looking to make a quick killing and while a very small number of cryptocoin investors do, the majority get killed themselves in terms of the tremendous losses they’re hit with.

If investors looked at Bitcoin’s meteoric rise and Ethereum’s recent, non-stop march to new high after new high on an almost daily basis the pattern should become clear. Goldman Sachs calls Bitcoin the new gold. Let that sink in.

There are a few coins truly worth of your time and attention and money but the other 2,000 or so digital currencies out there are not. As always, do your own research and make any investment decision based on a sound analytical basis and not because there is some fervent hope that the random shitcoin you bought at 2 cents will moon to over $2 in a week or two or a month. Let the cryptocoin trading tips I shared with you last week be your guide.