Tether Trouble Blasts Bitcoin – The Bitcoin Bad News Just Keeps on Coming

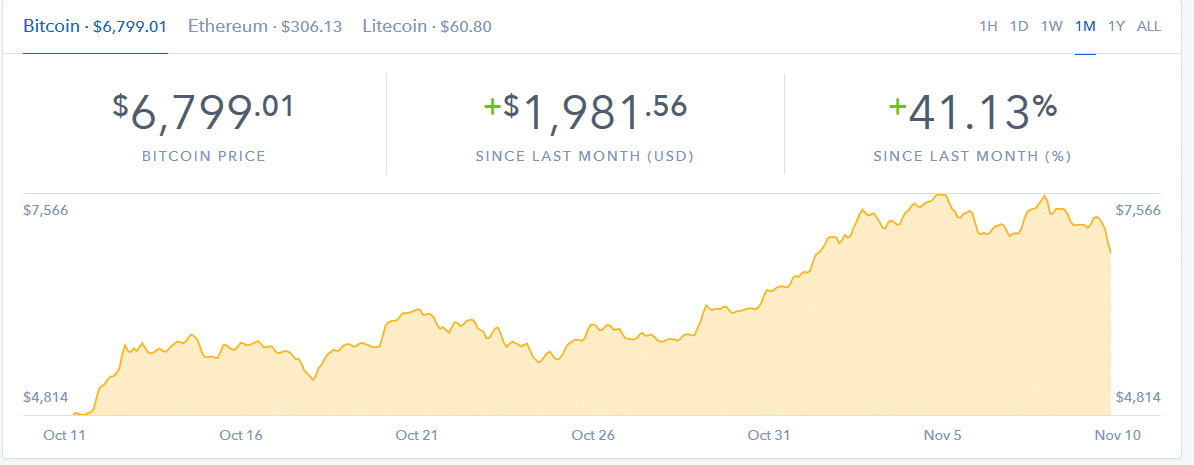

Tether trouble blasts Bitcoin to the tune of a $1,200 drop in price since yesterday sending Bitcoin below the crucial $10,000 psychological price point. Cryptocoin markets were jolted on the news that Tether’s auditors, Friedman LLP, got up and walked away. Tether’s side of the story is that they dismissed Friedman, LLP (that looks bad) Friedman, LLP has removed any and every trace of Tether from their website (that looks worse).

In a prior life I was a senior accountant on the fast track to making partner at an accounting firm and have been involved in my fair share of audits. And, for the record, I hold a degree in accounting which affords me expanded insights to speculate what happened that led to this relationship being “dissolved”. Accountants are held to high standards as put forth in GAAP (Generally Accepted Accounting Principles) and GAAS (Generally Accepted Auditing Standards). Let’s focus on GAAS.

Learn all about GAAS here. Summary: A completed audit, as reported by the firm conducting the audit, is a very comprehensive document giving a complete picture of the current state of affairs of the company.

An audit is a serious thing. When a respected firm like Friedman, LLP is expected to put their good name on the outcome of a company audit you can be sure that every fact will be there, every number provable with every i dotted and every t crossed. I have no doubt that Friedman, LLP went about this audit with the professionalism and attention to detail one would expect from a large, respected firm in business since 1924.

This seemed to bother the folks over at Tether who said as much….

“Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of tether, it became clear that an audit would be unattainable in a reasonable time frame.

“As tether is the first company in the space to undergo this process and pursue this level of transparency, there is no precedent set to guide the process nor any benchmark against which to measure its success.”

Tether trouble blasts Bitcoin pricing makes more sense when you consider they pushed back against the audit. This begs the question – “Do they have something to hide?” This event only adds fuel to the fire of Tether skeptics who doubt they have the cash reserves necessary ($1.6 billion? $3 billion? The opinions and estimates vary…) to back each Tether coin. The smart play here would’ve been to allow the audit to go through, share Friedman LLP’s findings with the public and squash further negative speculation once and for all.

The fact that this isn’t happening only fans the fires of critics and fuels fear.

This article from Bloomberg announcing Bitfinex and Tether have been slapped with subpoenas with the CFTC starting a US Federal investigation is the gasoline on the fire. The other worrisome news they reported is just kindling to keep that fire roaring.

Alas, Tether trouble blasts Bitcoin.

You may be asking yourself “But what’s the connection between Tether news and the price of Bitcoin?”

Good question, Grasshopper. Here’s the answer in a nutshell:

Bitfinex (the majority holder of Tether giving them control over the coin) is suspected of running a virtual printing press to create as much Tether as they want, whenever they want, contravening the stated policy of having one actual US dollar for every Tether coin issued. Why do this? To use Tether to buy Bitcoin without any actual value behind the purchase except for the perceived value of all of these Tether coins. Since Bitfinex can create all of the Tether they want with a snap of their fingers, they can buy all of the Bitcoin they want — without actually paying for it.

This model is similar Bitconnect’s model; they controlled Bitconnect Coin (BCC) and as a result pocketed millions or possibly billions in Bitcoin through BCC which never had any actual value.

If this is true and Tether craters (which would inevitably happen if these circumstances prove true) the price of Bitcoin would likely plunge to record lows not seen in a long, long time.

The New York Times seems to be the first to raise alarms about Tether and Bitfinex.

Moving forward I suggest everyone back out of Tether just in case. In the aftermath of The Bitconnect Bloodbath, investors should be understandably cautious and be conservative in this and all of their cryptocoin investing decisions.