Cryptocurrency Bubble History – What the DotCom Bubble Can Teach Us

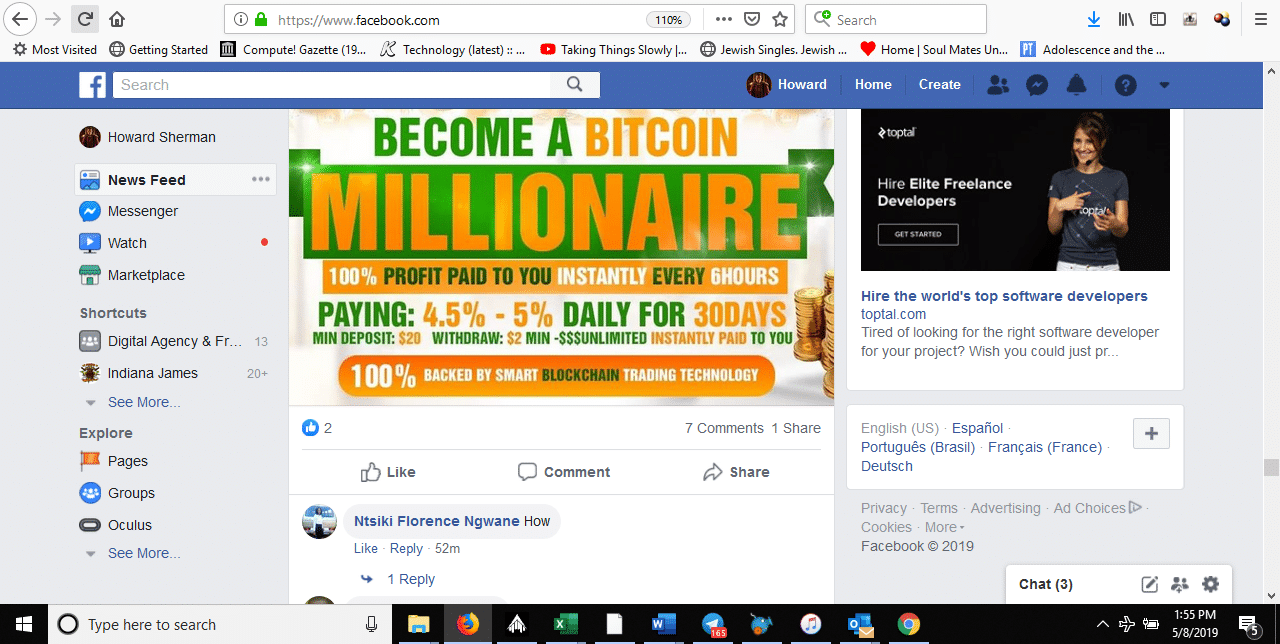

The explosion of the DotCom era and the subsequent plunge of almost EVERY Internet stock has many parallels to what I consider cryptocurrency bubble history. In the late 1990s, companies were raising millions of dollars in IPOs. The trick seemed to be just have “.com” in your company name and/or logo. ICOs up until recently had a very similar draw and legions of Lambo-seeking investors went crazy pouring every dollar they could into what seemed to be very lucrative cryptocoins. There are so many similarities between the DotCom Bubble and current cryptocurrency bubble history, it would be a very good idea to get warmed up on the DotCom Bubble.

While lots and lots and lots of people lost, collectively, BILLIONS of dollars during the DotCom Bubble, it needs to be said that the Internet we know and love today was born out of the ashes of the DotCom Bubble. History seems to be repeating itself with cryptocurrency bubble history.

Bitcoin is staging a slow but steady price comeback. Bitcoin mining equipment is starting to sell again. Just today the Wall Street Journal reported today Facebook is positioning itself into launching its own cryptocoin designed to be used all over the Internet and tightly integrated into the Facebook ecosystem.

CoinDesk seems to have known all along there would be a crypto comeback; they continued to roll out new services, expanded trading and grew the company while the cryptocurrency markets corrected.  The summary of cryptocurrency bubble history comes down to just two words; market corrections.

The summary of cryptocurrency bubble history comes down to just two words; market corrections.

As with the DotCom bubble, investors started paying very close attention to all of those Internet companies and asking some pointed questions; is this company serious? Do they have a realistic chance of pulling off what they set to do? What’s my time horizon for ROI? The next wave of Internet companies formed the foundation of the Internet we use today after FOMO fever drove so many people not only broke but into the poor house.

Parallels again; ICOs are virtually extinct, replaced by STOs and DSOs which have a reasonable amount of risk NOT the ludicrous risk ICOs had with whitepapers so worthless through fakery as to not even be useful as toilet paper.

For several months CryptoCapers.com decided to sit on the sidelines and just wait. We knew there was going to be a slow and steady market rebound. Up until just recently there was nothing much to write about. The Bitcoin price was basically stuck, other coins were cratering and new offerings were few and far between.