Bitcoin Price Reality

Bitcoin Price Reality – Separating Fact from Myth The recent plunge in Bitcoin – and almost every other cryptocoin out there – is attributed to all of the recent bad news. Bitcoin price reality needs to set in. Let’s tear apart all of the recent factors the “experts” are attributing

USI-Tech Closed to North America

USI-Tech Closed to North America – Covering Their Bet on the Texas Bitconnect Smackdown USI-Tech Closed to North America was a smart move by Dubai-based USI-Tech in light of the recent cease and desist letter they received from the Great State of Texas last month. What took them so long?

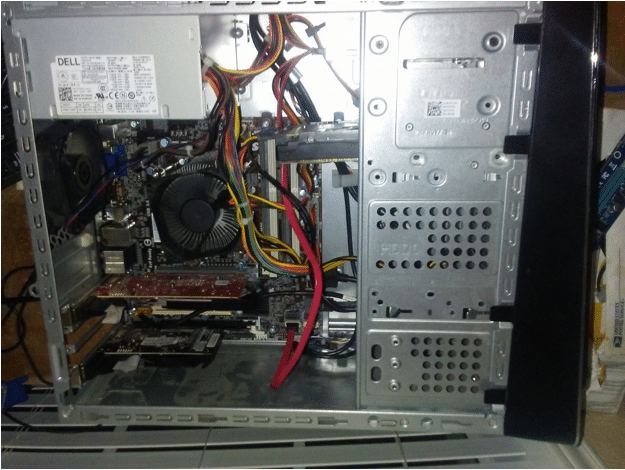

Bitcoin Mining for Beginners Episode 2

Building a Bitcoin Miner Starting Out Alright, so I was ready to start Bitcoin mining. Great! Now what? Well, cryptocurrencies won’t will their way to you, and you can’t just say “Hey Cortana, start mining Bitcoin.” What to do…what to do? (If you haven’t read my first installment in this