Coinbase Going Backwards

Coinbase Going Backwards – Elimination of Key Client Services + Needlessly Complicating Merchant Transactions = Disaster Coinbase going backwards has made life much more difficult the past few weeks. Up until March I could sell Bitcoin and turn it into usable cash in less than 30 minutes right from my

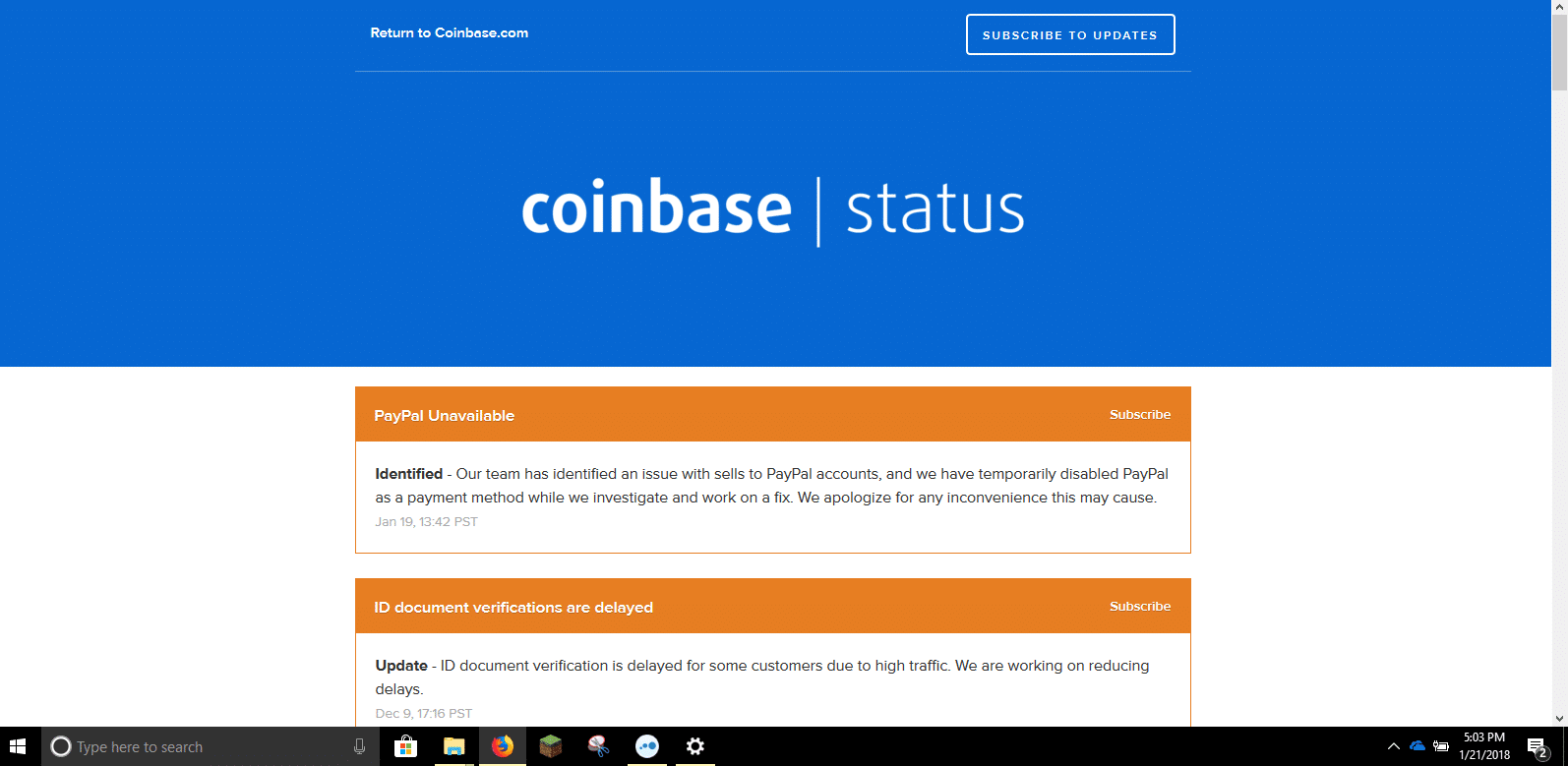

Coinbase Having Problems With PayPal

Coinbase Having Problems With PayPal – Technical Glitch or PayPal Policy? Yesterday I tried to move some funds from Coinbase to PayPal when I discovered Coinbase having problems with PayPal. I had made a Coinbase transfer to PayPal just a few days earlier which is what surprised me. I tried

Ripple XRP Craters on Coinbase News

Ripple XRP Craters on Coinbase News Wild speculation and unfounded rumors that Coinbase would be offering XRP trading were unfounded; as a result Ripple XRP Craters on Coinbase News that they are not offering XRP trades at the moment. Today XRP hit a low of $2.45 and hovered around and

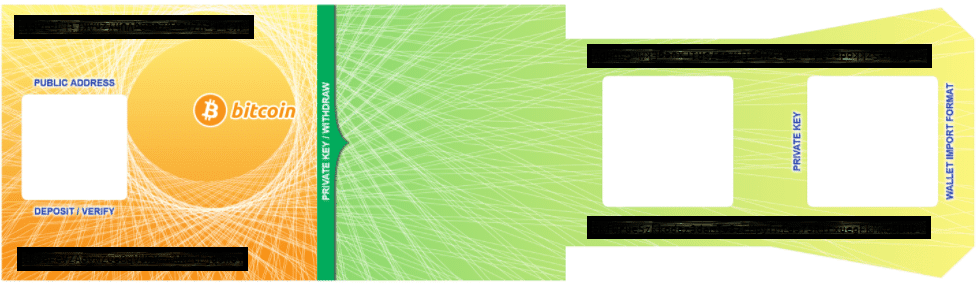

Bitcoin Mining for Beginners Episode 3

Creating a Bitcoin Wallet In my last installment, I had just completed my first mining rig and researched my cryptocurrency of choice. I then realized that I needed a bitcoin wallet, but I had no idea what this entailed. You see, the layman’s conceptualization of a wallet is one that