There’s no denying that the world of cryptocurrency has become a hot topic in recent years, and one of the most lucrative ways to get involved is through crypto mining. In this comprehensive guide, we will investigate the intricacies of crypto mining, how to get started, and, most importantly, how to profit in this competitive industry. Whether you are a beginner looking to dip your toes into the world of digital currencies or a seasoned investor seeking to expand your portfolio, understanding the fundamentals of crypto mining is vital. Stay tuned as we break down the key steps and best practices to help you navigate the ever-evolving landscape of cryptocurrency mining.

Key Takeaways:

- Understand the Basics: Before getting started with crypto mining, it is crucial to understand the basics of blockchain technology, cryptocurrencies, and how mining works.

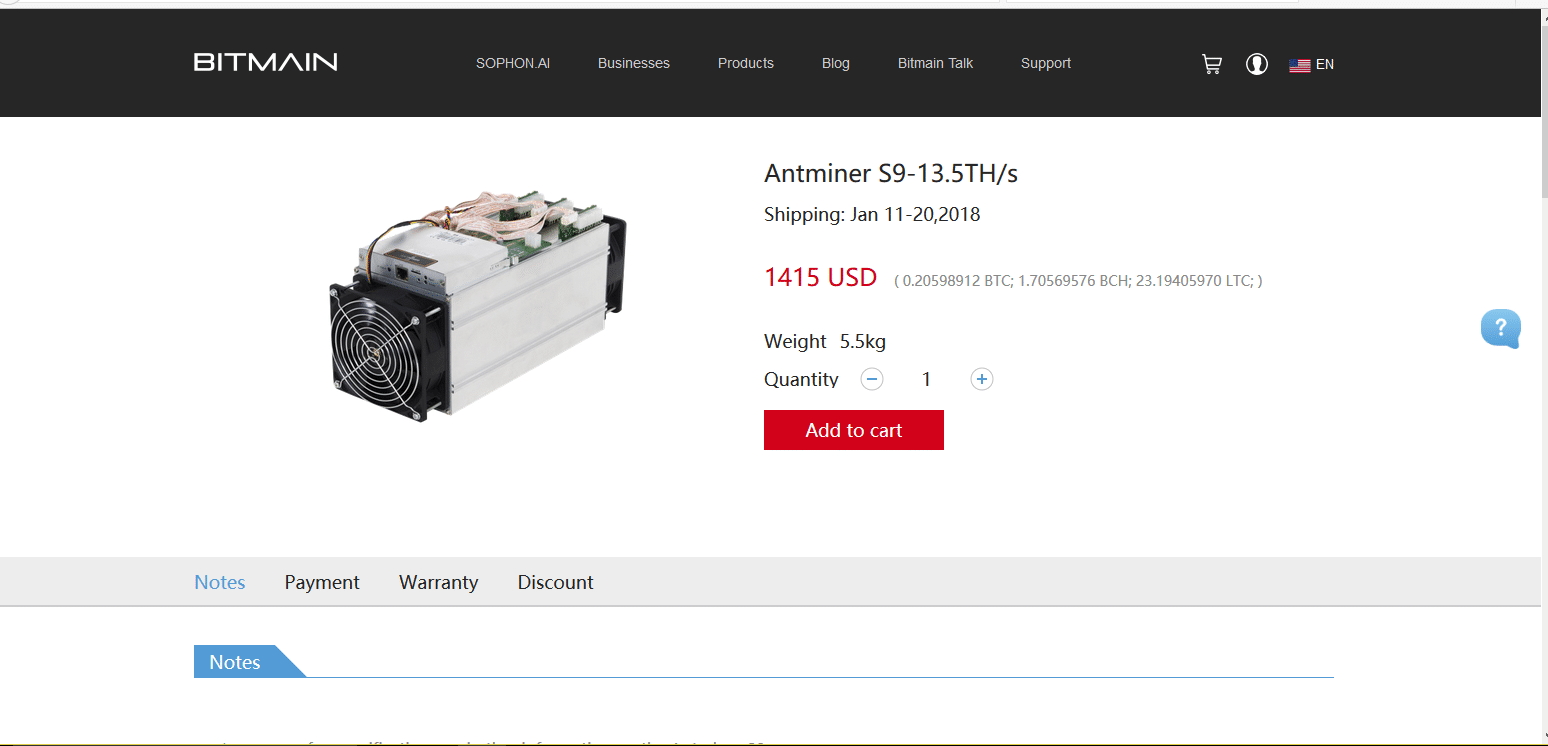

- Choose the Right Equipment: Selecting the appropriate hardware, such as ASIC miners or GPUs, is imperative to ensure efficient mining operations and profitability.

- Consider Costs and Profitability: Mining cryptocurrencies can be profitable, but it is important to calculate the electricity costs, mining pool fees, and potential returns to determine profitability.

Understanding the Mining Process

How Cryptocurrency Mining Works

On a basic level, cryptocurrency mining is validating transactions on a blockchain network by solving complex mathematical puzzles. Miners use powerful computers to compete in solving these puzzles, and the first one to solve it adds a new block to the blockchain and is rewarded with a certain amount of cryptocurrency.

Types of Mining: Solo vs. Pool vs. Cloud

On the other hand, mining can be done solo, where an individual miner competes on their own to solve the puzzles and receive the full reward. Pool mining involves multiple miners combining their computational power to increase the chances of solving the puzzles and sharing the rewards based on each miner’s contribution. Cloud mining allows individuals to rent mining equipment or hashing power from a remote data center.

- Solo Mining: One individual miner works independently to mine cryptocurrency.

- Pool Mining: Multiple miners collaborate and share rewards based on individual contributions.

- Cloud Mining: Renting mining equipment or hashing power from a remote data center.

- Cost-effective: Pool mining allows for shared resources, reducing costs.

- Consistent payouts: Cloud mining provides regular payouts for rented resources.

This breakdown showcases the different types of mining methods available to crypto miners. Each method has its own advantages and disadvantages, and it’s imperative to choose the one that best aligns with your goals and resources. This information is crucial for individuals looking to get started in cryptocurrency mining. It’s imperative to have a clear understanding of the various options available before exploring this competitive field.

Getting Started with Crypto Mining

Choosing the Right Hardware

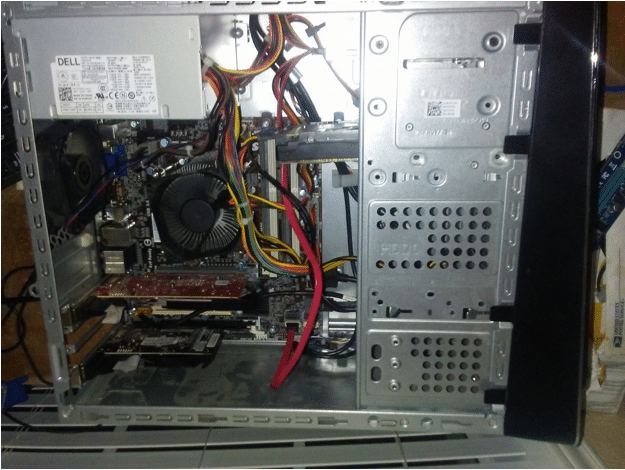

Selecting the proper hardware is crucial to successful crypto mining. The two main components you need are a powerful graphics processing unit (GPU) and a reliable mining rig. Research and compare different GPUs to find one that offers high hash rates and energy efficiency for maximum profitability.

Setting Up Your Mining Rig

Mining rigs are the backbone of your crypto-mining operation, so setting them up correctly is paramount. For instance, ensure that your rig has proper cooling systems to prevent overheating. Additionally, consider the location of your rig to optimize airflow and reduce the risk of hardware failure. Proper cable management is also essential to maintain a clean and organized setup, which can help prevent technical issues in the long run.

Optimizing Mining Operations for Profit

All cryptocurrency miners desire to maximize their profits by optimizing their mining operations. To get started, it is crucial to understand the mining basics, including setting up the necessary hardware and software. For detailed guidance on mining cryptocurrency, check out this How to Start Mining Cryptocurrency article.

Mining Strategies and Techniques

Strategies employed in cryptocurrency mining can significantly impact profitability. Factors such as choosing the right mining pool, optimizing mining hardware, and managing electricity costs must be considered. Techniques like overclocking hardware, using energy-efficient equipment, and staying updated with industry trends can help enhance mining efficiency.

Assessing Risks and Managing Costs

Profit in crypto mining is not only about revenue but also about minimizing risks and managing costs effectively. By conducting a thorough risk assessment, miners can mitigate potential threats to their operations. Strategies to manage costs include optimizing electricity consumption, finding cost-effective hardware solutions, and staying informed about regulatory changes that may impact mining profitability.

Techniques such as tracking performance metrics, monitoring market fluctuations, and implementing proper security measures can further help miners assess risks and manage costs efficiently.

Staying Ahead: The Future of Crypto Mining

Emerging Trends in Mining Technology

One of the emerging trends in mining technology is the development of more energy-efficient hardware solutions. As the industry continues to grow, there is a push to reduce the environmental impact of mining operations. Manufacturers are working on creating mining rigs that consume less power while still maintaining high performance, making them more cost-effective for miners in the long run.

Legal and Regulatory Considerations

A necessary aspect of crypto mining that miners must consider is the legal and regulatory landscape governing their operations. Regulations vary from country to country, and some jurisdictions have imposed restrictions or outright bans on mining activities. Before commencing a mining venture, conducting thorough research on the legal framework surrounding cryptocurrencies in your location is crucial to ensure compliance and mitigate any potential risks.

It is also essential to stay informed about any upcoming regulations or changes in existing laws that could impact your mining operations. Engaging with legal professionals specializing in cryptocurrency law can provide valuable insights and help navigate the complex regulatory environment.

Trends in Mining

As the crypto mining industry evolves, we can expect to see continued advancements in technology, with a focus on sustainability and efficiency. Additionally, regulatory frameworks are likely to become more defined as governments worldwide grapple with the challenges and opportunities presented by cryptocurrencies. Staying proactive and adaptable to these changing landscapes will be vital to staying ahead in crypto mining.

To wrap up

Hence, stepping into the crypto-mining world can be profitable for those willing to invest the time, resources, and effort required to succeed. Understanding the basics, selecting the right equipment, and staying up-to-date with industry trends are necessary steps to take. By carefully managing costs and optimizing mining operations, individuals can maximize their chances of generating significant profits in this rapidly evolving field. Ultimately, with the right approach and dedication, crypto mining can be a rewarding endeavor for those looking to explore the potential of this innovative technology.

FAQ

Q: What is crypto mining?

A: Crypto mining validates transactions on a blockchain network by solving complex mathematical puzzles using high-powered computers. Miners are rewarded with cryptocurrency for their contribution to securing the network.

Q: How can I get started with crypto mining?

A: To get started with crypto mining, you will need to choose a cryptocurrency to mine, acquire the necessary hardware (such as ASIC miners or GPUs), download mining software, join a mining pool for a higher chance of earning rewards, and stay updated on the latest mining trends and technologies.

Q: Can I make a profit from crypto mining?

A: While it is possible to profit from crypto mining, factors such as electricity costs, mining difficulty, hardware expenses, and market conditions must be considered. Thorough research and a cost-benefit analysis should be conducted before investing in crypto mining equipment.