Coinbase Commerce – Striking Back at The Banks and Hitting Them Where it Hurts

Coinbase Commerce empowers over 48,000 businesses to accept Bitcoin, Bitcoin Cash, Litecoin and Ethereum alongside Visa, MasterCard, Discover and American Express. This alone silences the critics that often cite Bitcoin and other cryptocoins as being useless since cryptocurrency can’t be spent anywhere.

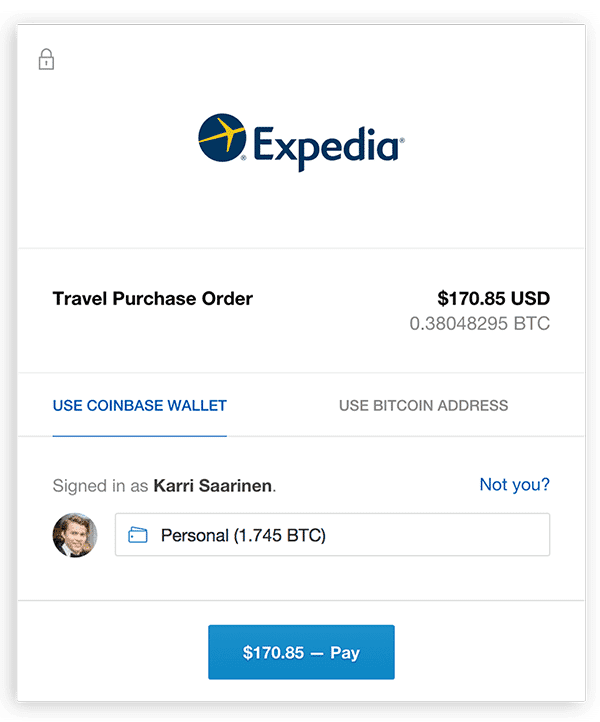

Thanks to Coinbase Commerce the four major cryptocoins can now be spent EVERYWHERE. From the big boys like Dell, Microsoft, Expedia, Intuit, Bloomberg and Dish Network to much smaller online merchants, accepting cryptocoin for payment can be implemented in just a few minutes. With such a simple and swift implementation process it’s easy to imagine websites accepting Bitcoin for payment numbering into the hundreds of thousands in no time at all.

Coinbase commerce is a dream come true for online merchants. That’s because online merchants face the bane of their existence in the form of credit card chargebacks. That’s when a consumer disputes a credit card charge with the issuing bank of the credit card. Within a couple of days the merchant’s bank account is hit and the funds are removed. The merchant then has to respond to the chargeback and then hope for the best. Hope for the best? Yes indeed. One of my other businesses, crowdfunding promotion firm Crowdfund Buzz, has only been successful in winning a chargeback case just 50% of the time. The other 50% means that the customer ends up getting our services for free. Online merchants selling products have the same pain; they ship the goods (think Apple MacBooks, Gucci handbags) then get slapped with a chargeback. To add more pain to the process, researching and submitting the documentation needed to answer a chargeback is time consuming AND the merchant typically waits TWO MONTHS for the decision. Even with breathtaking documentation (I typically provide a 45 page response LOADED with proof of work, proof of client acceptance, etc. as other vendors provide FedEx or UPS proof of delivery, etc.), too many chargeback challenges fail. In that case the customer gets to keep the goods or services – and the money. It’s become so common that it has garnered a term all its own; “friendly fraud”. By the year 2020 friendly fraud will cost merchants $25 billion per year at the current pace.

With Coinbase commerce that’s a thing of the past. Chargebacks are impossible and businesses can sell the crypto they received as payment instantly and receive fiat currency just as quickly as if they made that sale with a credit card. It’s not hard to imagine online merchants accepting cryptocoin in droves then eliminating credit cards from their websites. This has already started and I predict will continue to gain momentum.

Banks rake in $200 billion per year on credit cards from the merchant fees imposed to interest charges, annual fees and all the rest of them. Coinbase commerce will steer some of that money their way through the transaction fees they’ll earn on every transaction. With wider adoption cryptocoin becomes more mainstream, consumers have a lighter debt load and this must have the banks scared to death.