Bitcoin Cloud Mining is a Minefield. Here’s Why.

The math doesn’t work. Bitcoin cloud mining makes no economic sense. If you OWN a mining farm why not make the most money possible just mining cryptocoin yourself? That’s the best way to make the highest profits possible. If you’re selling bitcoin cloud mining services you’re not making as much money as you can. Bitcoin cloud mining companies need to spend a mountain of money on advertising and affiliates, maintain a larger staff to monitor all of the equipment and maintain a reporting and payment platform. All of that costs money.

And if you ARE selling bitcoin cloud mining then the the poor sucker paying for these services truly learns too late that that bitcoin cloud mining is a minefield. Between the fees you pay to the Bitcoin cloud mining company and the potential profit you could make on the sale of cryptocoin you’re really not making any real money. That’s assuming, of course, that the Bitcoin cloud mining company is honest in the first place. Many of them aren’t and you have no way of knowing one way or the other.

What Is Bitcoin Cloud Mining?

By and large cloud mining means using shared processing power running in data centers. Would-be cloud miners need no special equipment of any kind to oversee operations.

At first glance cloud mining of any kind seems attractive:

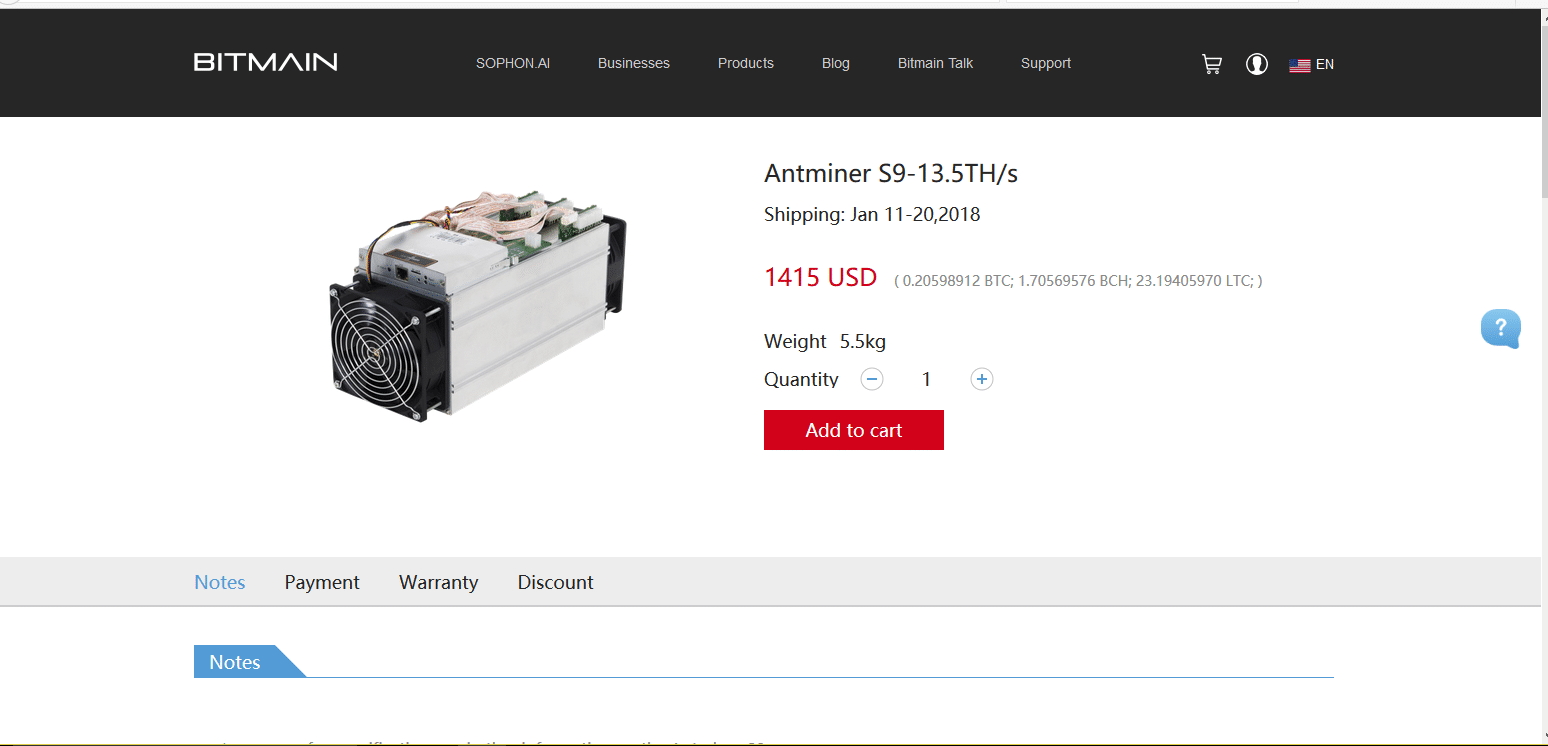

- No upfront equipment acquisition costs like an ASIC miner or Ethereum mining rig which are hard to find at retail and usually sell for A LOT above retail via resellers on eBay and other places

- A quiet, cooler home – no constantly humming fans from above-mentioned dedicated equipment

- No added electricity costs – this is easily the single biggest expense of any cryptocoin miner

- No ventilation problems with hot equipment (this could be a real hassle in summertime)

Upon closer inspection cloud mining should be avoided for all of these reasons:

- Very high risk of fraud since it’s impossible to accurately verify you are receiving the services you paid for AND/OR receiving your earnings

- Lower profits –Cloud mining has fees that severely cut into potential profits (more about this below)

- A passive approach to cryptocoin mining — you have zero control over operations and if things go wrong you are powerless to rectify problems.

Types of cloud mining

- Hosted mining

Lease a mining machine that is hosted by the remote company. NOTE: This is going to end up costing you much more than buying your own equipment in much the same way leasing a car ends up wasting a lot of money as opposed to buying a car. - Virtual hosted mining

Deploy a virtual server and install your own mining software. This is no longer a viable option and is not widely available. - Contracted hashing power

You pay for a committed amount of hashing power which is delivered via the cloud mining company’s own network. This is the most widely available option.

Is Bitcoin Cloud Mining Profitable?

Nope. Consider that one of the bigger cloud mining companies sells 5 TH/s (Tera Hashes per second) of hashing power for $845 PER MONTH. Other companies offer very low pricing on VERY LOW GH/s processing power PLUS maintenance fees.

To put this into perspective consider the fact you can PURCHASE an Avalon Miner 741 delivering 7.1 TH/s for $898 as a one-time payment and you own the equipment outright. Factor in power supplies and an Avalon controller for total hardware acquisition costs of roughly $1198. For this reason alone the math doesn’t work when it comes to bitcoin cloud mining.

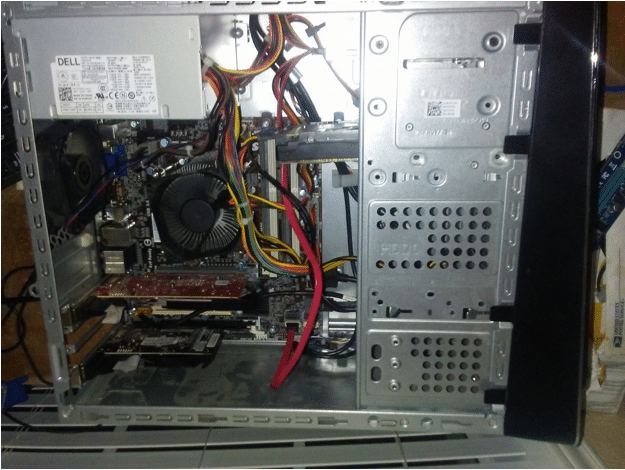

I investigated bitcoin cloud mining when I entered the Bitcoin world. For all of these reasons and more I decided to invest in my own bitcoin mining equipment and run my own Bitcoin mining farm and run the show myself. This gives me total control over the process, higher profits and absolute certainty of the money I am making every minute of every day.